COVID-19 Impact on Indian housing market

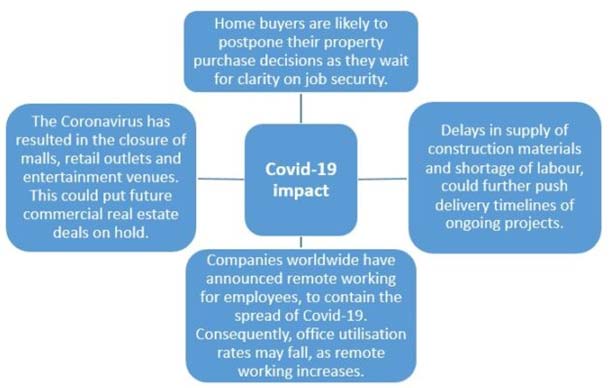

The magnitude of the pandemic has sparked concerns on whether the economy will revive and if the commercial real estate sector can bounce back or not.

The Coronavirus spread has further delayed a recovery that might have seemed possible because of various government launched measures to revive demand though right now it doesn’t seem like prices will go down immediately.

Niranjan Hiranandani, national president, NAREDCO, states that “Salvaging Indian realty, the second-largest employment generator is critical, not only from the GDP growth perspective but also for employment generation, since the sector has a multiplier effect on 250-plus allied industries.””

The centre in the recent past had announced higher tax breaks and lower interest rates on home loans to make purchases more lucrative, apart from setting up an Rs 25,000-crore stress fund for stuck projects.

The demand slowdown in the residential segment has already curtailed housing sales, project launches and price growth in India’s residential realty sector, which has been reeling under the pressure caused by mega regulatory changes caused by the Real Estate Regulatory Authority (RERA), the Goods and Services Tax (GST), demonetisation and the benami property law.

According to rating agency ICRA, the pandemic, if not contained soon, would not only significantly impact the economy but also adversely hit developers’ cash flows and project delivery capabilities.

“In case of a longer outbreak though, the impact on overall economic activity is likely to be deeper and more sustained, which would result in a more significant impact on developer cash flows and project execution abilities, giving rise to wider credit negative implications,” ICRA said in a recent note while also adding that the three-month moratorium announced by the RBI on March 28 on loans will provide some comfort to builders. This moratorium was subsequently extended by the RBI, on May 22, 2020, till August 31, 2020.